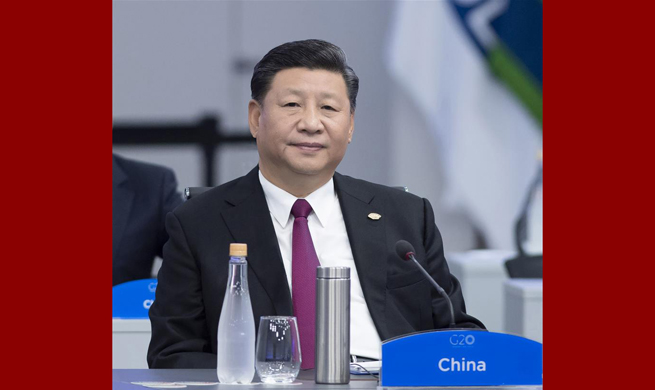

CHICAGO, Dec. 1 (Xinhua) -- Chicago Board of Trade (CBOT) agricultural commodities closed higher over the trading week which ended Nov. 30, as investors turned to technical buying amid expectations for U.S.-China trade talks during G20 meeting.

The most active corn contract for March 2019 delivery rose 7.25 cents weekly, or 2.02 percent, to 3.7775 dollars per bushel. March 2019 wheat delivery was up 8.5 cents, or 1.58 percent, to 5.1575 dollars per bushel. 2019 January soybean added 13.75 cents higher, to 8.9475 dollars.

CBOT March corn rallied over 7 cents on the week. The advance was due to optimism surrounding this weekend's G20 meeting in Buenos Aires of Argentina.

Additional acres are certainly needed, but whether area expands adequately will be determined by Asian buyers' return to the U.S. soy market. Otherwise, world cash basis levels continue to improve.

Gulf corn holds a modest discount into Asia through the early part of spring. Ethanol margins will remain depressed until better ethanol export demand is found.

Wheat futures ended higher on fund short covering ahead of the weekend G20 meeting and as incremental export demand for the United States.

Export sales last week were only routine, but since last Thursday the United States has sold two cargoes to Egypt, and there's at least talk that hard red wheat is close to working to North and Sub-Saharan Africa.

Winter wheat acreage expansion is no longer expected in the United States amid adverse autumn weather. Sales are only advised on strong rallies. The need for favorable 2019 world weather is high amid declining non Asian stocks.

Soybeans were under pressure at the start of the week, but the early break uncovered strong demand that supported the market into late week.

Funds were short in the soybean market and used the break to cover positions ahead of the G20 Summit. Fundamentally, U.S. soybean supplies are record large, but its export demand remains very weak in past 6 months.

Without large demand from overseas market, U.S. soybean stocks will remain historically large, which leaves the market outlook bearish on any fund covering rallies.

Longer term, a record large Brazilian harvest is expected to get under way in late December, with significant exports to begin by late January. A long Brazilian export tail will weigh on U.S. exports for much of 2019, and on into the new crop harvest.