BEIJING, March 9 (Xinhua) -- The following are the key moves taken by policymakers in the past week to enhance China's economic strength and sustainability.

-- Growth, reform targets for "crucial year"

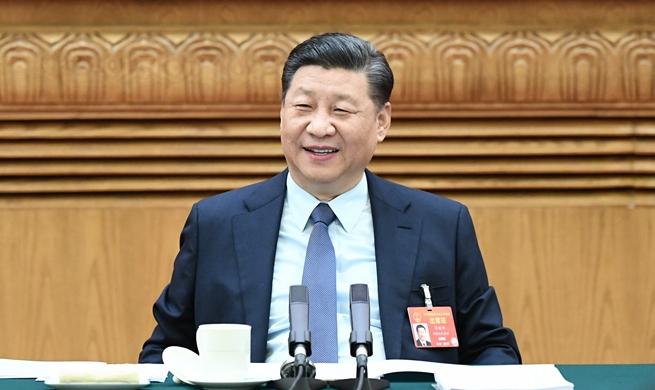

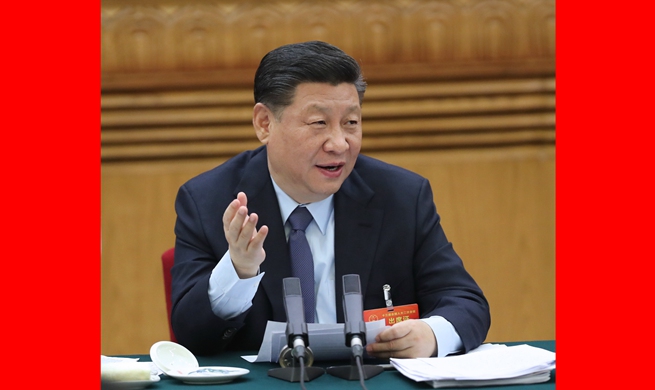

China on Tuesday unveiled its growth and reform targets for 2019, a "crucial year" in the country's endeavor to build a moderately prosperous society in all respects by 2020.

The world's largest developing economy set its new year GDP target at 6-6.5 percent and aimed to maintain consumer inflation level at around 3 percent and create over 11 million new urban jobs.

The surveyed urban unemployment rate is projected to stay around 5.5 percent, the registered urban unemployment rate within 4.5 percent, according to a government work report delivered at the opening of the second session of the 13th National People's Congress (NPC), China's national legislature.

----Easing corporate tax and fee burden

China will reduce the tax burdens and social insurance contributions of enterprises by nearly 2 trillion yuan (about 298 billion U.S. dollars) this year, according to the government work report.

In 2018, the tax and fee burdens on enterprises and individuals were reduced by around 1.3 trillion yuan, said the report.

----Prudent monetary policy to "right degree"

China will ease and tighten its prudent monetary policy to the right degree, flexibly using a variety of monetary policy instruments to effectively mitigate difficulties faced in the real economy, especially by private enterprises and small and micro businesses, according to the government work report.

The country will also improve the exchange rate mechanism and keep the RMB exchange rate generally stable and at an adaptive and balanced level.

----IMF allowed to access China's capital market via RQFII program

China's securities regulator has allowed the International Monetary Fund (IMF) to access the country's capital market via the RMB Qualified Foreign Institutional Investors (RQFII) program.

The RQFII mechanism was launched in 2011 to widen investment channels for overseas yuan funds on the Chinese mainland, allowing those that qualify to invest in China's securities market within a permitted quota. It aims partly to increase the international use of the RMB.

As of Feb. 27, the RQFII quota came in at 660.47 billion yuan (about 98.4 billion U.S. dollars), according to the State Administration of Foreign Exchange.

----New tech board sets to boost innovation, financing

China's new science and technology innovation board is racing toward the finish as the country pins hope on the board to capitalize its innovation-driven development and financial reform.

The launch of the new board has entered a "sprint" stage, and the technical system is expected to be ready by the end of May, the Shanghai Stock Exchange (SSE) said Tuesday.

According to the SSE, the board's issuance system is ready, adjustment of the listing system is underway and it plans to conduct a debut test at the end of March.

Proposed in November 2018 and approved in January, the new board will be launched on the SSE and experiment with registration-based initial public offerings (IPOs). Trading and listing rules for the board were published last week.