NEW YORK, June 5 (Xinhua) -- Global oil prices are expected to teeter for the remainder of the year, as trade tensions and U.S. crude inventories buildup continue to incur losses, yet output cut efforts by OPEC and its allies (OPEC+) would underpin the market, according to analysts at the world's leading investment banks.

MARKET ROILED BY FEARS OVER TRADE, SUPPLY GLUT

The global oil market has taken a heavy toll due to heightened worries about weakening global economic growth, triggered by trade frictions between the United States and its trading partners.

Both crude benchmark prices suffered their largest monthly losses in May since November 2018, with the West Texas Intermediate (WTI) plunging 16 percent and Brent crude tumbling 11 percent.

More specifically, both prices sank 10 U.S. dollars per barrel over the last two weeks, owing to growing concerns over waning demand amid slowing global economy.

"Worsening global trade tensions also stirred up global growth concerns and eventually resulted in slower oil demand growth," Swiss investment bank UBS said in a report on Tuesday.

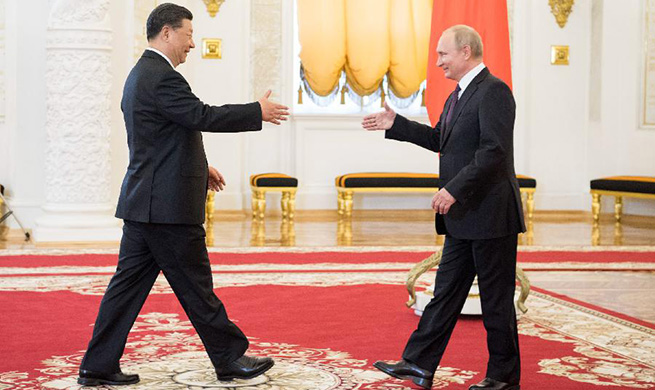

In an escalation of the trade tensions, Washington on May 10 increased additional tariffs on 200 billion U.S. dollars' worth of Chinese imports from 10 percent to 25 percent, and has threatened to raise tariffs on more Chinese imports. In response, China raised additional tariffs on a range of U.S. imports on June 1.

Trump threatened on May 30 to impose a 5-percent tariff on Mexican products as of June 10 and gradually increase the figure to 25 percent in October if Mexico does not stop the flow of illegal migration that reaches its border with the United States.

The move sent WTI sharply falling 3.09 U.S. dollars, while Brent crude dropping 2.38 dollars the following day, as Mexico is a major supplier of crude oil for the United States with lucrative cross-border energy trade.

"While tight fundamentals supported oil prices through mid-May, escalating trade wars and weaker activity indicators have finally caught up with oil market sentiment," Goldman Sachs said in a recent research note.

To make things worse, strong U.S. production growth and surging inventories have exacerbated downward pressures on oil prices.

Both U.S. crude and Brent crude slumped more than 1 U.S. dollar on Wednesday, amid broad jittery over supply gluts from a surprising buildup in U.S. crude stockpiles last week.

In particular, WTI plunged over 20 percent from its April peak to hit the lowest level since January, thus sliding into bear-market territory.

U.S. crude oil inventories shot up by 6.8 million barrels from the previous week, the U.S. Energy Information Administration reported on Wednesday.

For the week ending May 31, the stockpiles registered 483.3 million barrels, about 6 percent above the five year average for this time of year.

OPEC+ EFFORTS AT BACK OF PRICES

"The addition of new U.S. supply and its integration into the global market" would pose a "multi-year threat to the market share and revenues" of OPEC+ producers, Goldman Sachs noted.

To shore up prices, OPEC has conveyed signals to extend the six-month-long supply cut deal with its allies into the second half of the year. The two sides will discuss its policy at a highly anticipated meeting later this month or in early July.

Saudi Arabia's Minister of Energy, Industry and Mineral Resources, Khalid A. Al-Falih, indicated that the oil cartel would continue to sustain market stability beyond June, pointing to continuous output reduction.

"To me, that means drawing down inventories from their currently elevated levels," the minister was quoted as saying by Saudi newspaper Arab News on Monday.

"High compliance to OPEC's oil production deal and lower on-land oil inventories over the coming months should lead to supply-and-demand deficits in the second and third quarters, putting renewed upward pressure on prices," Swiss investment bank UBS said in its report.

Therefore, the bank held that the high compliance of OPEC+ to supply cut and U.S. sanctions that lowered production in Venezuela and Iran would lead to a faster drop in global oil supply than weaker demand over the last six month.

"So we expect the current market focus on trade tensions and oil demand growth to yield soon to the supply dynamics of OPEC+ curbs and the lower output from Iran and Venezuela," UBS noted.

Despite high price volatility, Goldman Sachs still expected the benchmark prices to likely remain at current levels, considering "an increasingly uncertain macro outlook as well as rising U.S. production and large available core-OPEC spare capacity" that would help offset supply reduction of Iran and Venezuela.