HOUSTON, Nov. 9 (Xinhua) -- Oil prices gained ground for the week ending Nov. 8, with the price of West Texas Intermediate (WTI) for December delivery up 1.85 percent and Brent crude oil for January up 1.33 percent.

WTI closed the week at 57.24 U.S. dollars a barrel on the New York Mercantile Exchange, while Brent crude for January finished the week at 62.51 dollars a barrel on the London ICE Futures Exchange.

WTI and Brent crude prices have increased 26.05 percent and 16.19 percent, respectively, so far this year, falling from their peak levels in April when the growth of WTI hit over 40 percent, and Brent crude over 30 percent.

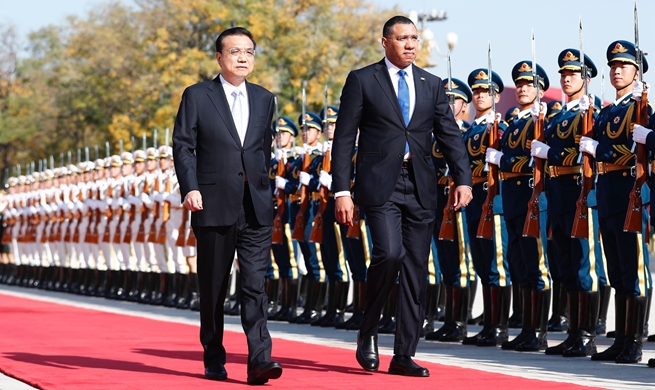

On Monday and Tuesday, oil prices enjoyed big gains after improved U.S. and Chinese economic data aided the demand outlook, while optimism increased over the resolution of the two countries' trade dispute. WTI increased 1.03 dollars while Brent crude advanced 1.27 dollars for the two days.

Oil prices declined on Wednesday after data showed U.S. crude inventories increased more than expected and a report that the Organization of the Petroleum Exporting Countries (OPEC) and other major oil producers were not pushing for deeper oil-supply cuts. WTI lost 0.88 dollar and Brent crude erased 1.22 dollars for the day.

U.S. commercial crude oil inventories increased by 7.9 million barrels during the week ending Nov. 1 from the previous week, the U.S. Energy Information Administration said on Wednesday.

Oil process recovered over the rest of the two days of the week as trade optimism booted investors' confidence that fuel demand will pick up. Both WTI and Brent crude gained nearly one dollar for the two days combined.

Oil prices have kept gaining momentum since the start of the year due to some geopolitical concerns and the OPEC's decision of production cut. However, the momentum has slowed down, mainly because of the concerns over downturn in demand for crude oil.

The slowing global economy continued to be a major headwind for crude oil. The slower economic growth of the world will lead to less demand for oil, which in turn would put downward pressure on oil prices.

According to its October Monthly Oil Market Report (MOMR), the OPEC forecast that the global economic growth remains unchanged at 3.0 percent for 2019, but it was revised down for 2020 to stand at 3.0 percent, compared to 3.1 percent in the previous month's assessment.

Moreover, a rising U.S. dollar in the past months has dragged down the greenback-denominated crude futures as the U.S. Dollar Index has been keeping uptrend since mid-2018, although the U.S. Dollar Index remained under heavy bearish pressure in October.

The index ended the week above the 98.30 level, hitting three-week highs. Analysts said the index may try to break 99.00 level in the coming weeks.

For the coming week, the investors will continue to pay close attention to market demand forecast. The OPEC said that trade-related issues are further dampening the growth momentum.