CHICAGO, Jan. 18 (Xinhua) -- Chicago Board of Trade (CBOT) crop futures ended this past week mixed as the United States signed or passed important deals with its key trading partners including China, Canada and Mexico.

The most active corn contract for March delivery was up 3.5 cents, or 0.9 percent week on week, to close at 3.8925 U.S. dollars per bushel. March wheat was up 6 cents, or 1.1 percent, to settle at 5.705 dollars per bushel. March soybeans were down 16.25 cents, or 1.71 percent, to close at 9.2975 dollars per bushel.

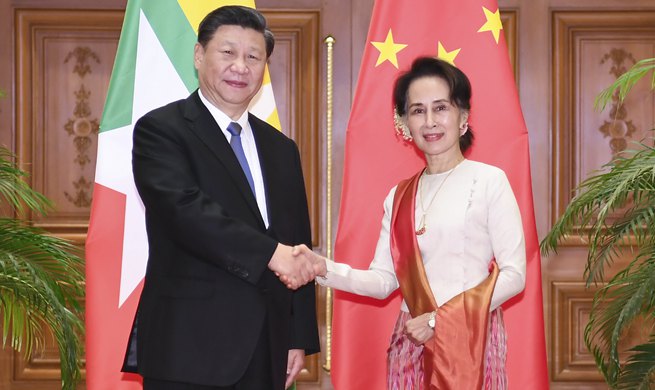

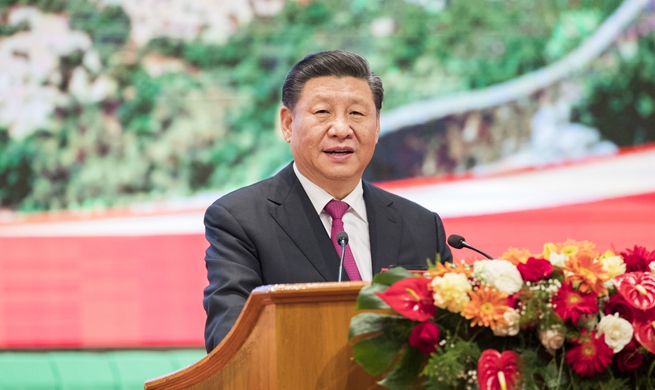

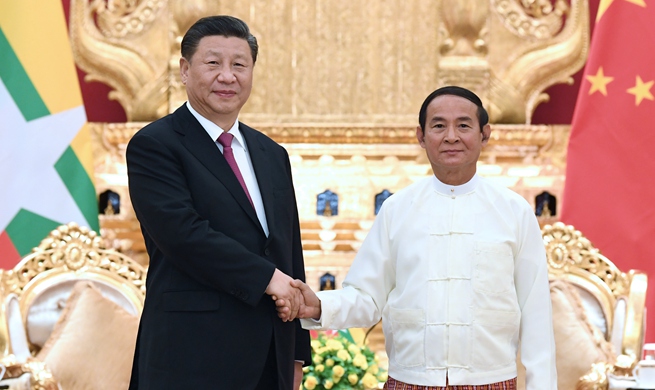

China and the United States signed their long-awaited phase-one economic and trade agreement in Washington on Wednesday. The U.S. Senate on Thursday passed a sweeping economic pact with Canada and Mexico following House approval in December 2019.

Market participants generally expect that the China-U.S. trade deal will significantly increase U.S. crop sales to China.

Yet CBOT crop futures failed to post further gains immediately after the signing ceremony. Some analysts said the big event was already priced in.

According to CBOT data, Chicago soybean futures gained some 70 cents in the previous six weeks. A double-digit plunge on Wednesday in soybean prices offered a chance for bargain hunters.

"We're at the bottom end of the range, which I think might represent a decent buying opportunity," said Oliver Sloup, vice president of Blue Line Futures.

Some others cited competition from South American crops, expressing doubts about the scale of the Chinese purchases of U.S. soybeans, especially when new crop supply from Brazil becomes available in February.

Bargain buying did push up all the three commodities across the board on Friday, with corn rebounding more than 13 cents. The rally also took place after the U.S. Senate gave its final approval to the new U.S.-Mexico-Canada Agreement (USMCA), another bullish factor for crop export sales.

Mexico and Canada are the U.S. corn industry's largest markets, and Mexico is also the second largest market for U.S. whole beans, meal and oil.

Meanwhile, Mexico's flour millers import more U.S. wheat than any other country, according to the U.S. Wheat Associates.

Firmer European wheat prices also gave a boost to Chicago wheat, along with reports that Russia is considering export quota for the grain.

"The fact that they are talking about or thinking about limiting exports has got the wheat market fairly excited in the wheat chart," said Ted Seifried, analyst with Zaner Ag Hedge.

Additional support came from the upbeat weekly export data released by the U.S. Department of Agriculture.

Net wheat sales for 2019/20 marketing year reached 650,600 metric tons between January 3-9, up noticeably from the previous week and up 32 percent from the prior four-week average.

Corn sales of 784,800 metric tons for 2019/20 export delivery were also up noticeably from the previous week and up 4 percent from the prior four-week average.

As for U.S. soybeans, net export sales during the same period were pegged at 711,500 metric tons for 2019/20 marketing year, also up from the previous week and the prior four-week average.