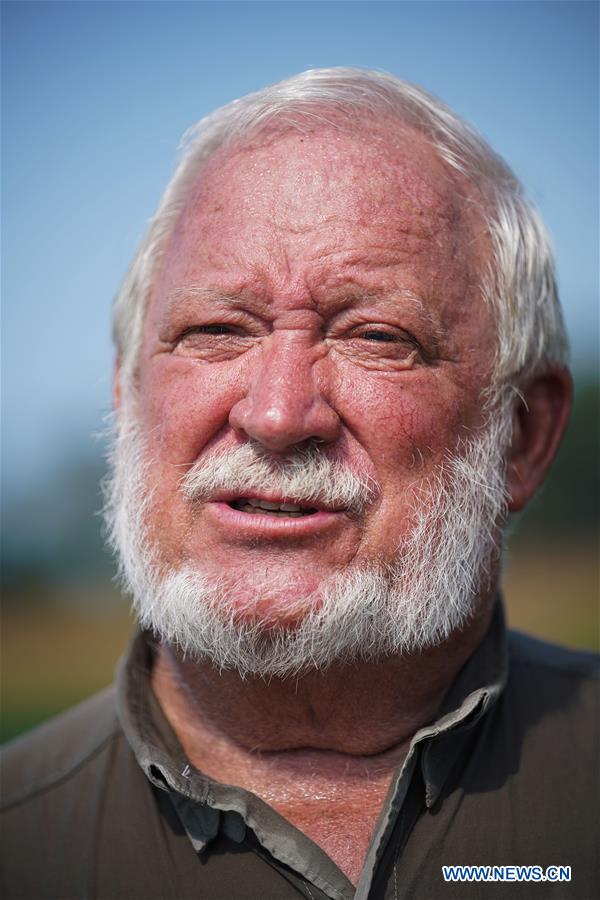

Cotton farmer Joe Boddiford speaks during an interview at his farm in Sylvania, Georgia, the United States, on Aug. 1, 2019. Cotton farmer Joe Boddiford said prices for his crop recently "have best been flat and poor." He said cotton future prices in his area are around 62 to 63 cents per pound right now, compared with the pre-trade tensions level of 80-90 cents a pound. (Xinhua/Liu Jie)

by Deng Xianlai and Xu Yuan

SYLVANIA/MEMPHIS, the United States, Aug. 6 (Xinhua) -- Cotton farmer Joe Boddiford said prices for his crop recently "have best been flat and poor."

Boddiford now grows some 950 acres of cotton on an expanded family farm passed on to him in 1974. He said cotton future prices in his area are around 62 to 63 cents per pound right now, compared with the pre-trade tensions level of 80-90 cents a pound.

U.S. cotton exports to China have also declined substantially due to the U.S.-initiated trade disputes.

"I can't remember how many years ago, but I actually went from two-dollar cotton out there," said the 70-year-old, who has been planting cotton since 1991 on his 2,400-acre farm located on the outskirts of Sylvania, a city in the state of Georgia.

SCARCE ALTERNATIVES

When cotton farmers like Boddiford harvest the crop, they sell it to people who have the machine known as a cotton gin, which separates cotton fibers from seeds. Then merchants buy the deseeded bolls and sell them to spinning mills, where the fibers are further processed to make textiles that consumers ultimately purchase.

Given the many intermediaries between him and an end user, Boddiford does not really have control over the price that consumers will pay for clothes made from his cotton.

"I feel like I've done my part if I can get the yield out ... but I hope that I can capture the better prices during the year," Boddiford said, adding that he will not sell his crop to local gin companies until cotton prices go up.

Pointing at the piles of cotton bales stocked in his warehouse, Duane Bargeron, general manager of the nearby Screven Gin Co., Inc., said his ideal price is 75 cents per pound, which he hoped would happen in the September-October harvest season this year.

Chances are that Bargeron would be disappointed, as the U.S. Department of Agriculture's (USDA's) latest forecast showed that cotton prices are to remain at the low sixties in the 2019 marketing year, according to the department's World Agricultural Supply and Demand Estimates (WASDE) published on July 11.

U.S. cotton planting is projected to be 13.7 million acres this year, a slight decrease from last year's 14.1 million acres, according to the monthly WASDE report.

When cotton farmers make planting decisions, they do not just look at cotton prices. "They look at the cotton price relative to competing crops, and there really weren't any other good alternatives," said Gary Adams, president and CEO of the Memphis, Tennessee-headquartered National Cotton Council of America.

Adams' words attest to Boddiford's situation. "I don't have any plans to change," the farmer said. "We've got so much money invested into any particular part of this infrastructure. It can be financially devastating to just say I quit growing cotton."

CHINA CONSUMPTION

The impact of the U.S.-China trade disputes are much more remarkable when seen through the prism of Chinese purchases of U.S. cotton.

The quantity tumbled from some 5 million bales in 2012-13 to somewhere between 1.7-1.8 million bales in the 2018 marketing year, according to Adams.

Bale is the packaging unit used in cotton trade. In the USDA calculation, one bale of cotton weighs 480 pounds.

China, Adams said, has a textile industry that consumes the largest volume of cotton in the world -- about 40 million bales annually, or roughly one third of the global production. "Normally, we would say China has been the largest international customer of U.S. cotton."

However, the market share of U.S. cotton in China tumbled to a range of 11 percent to 13 percent in the past year, from 44 percent to 45 percent during the two years leading up to the trade tensions, according to Adams.

"The impact has and continues to be very significant (to) the U.S. cotton industry," he said.

Given the unparalleled magnitude of China's cotton demand, potential gains in other markets by no means would offset what Adams perceived to be a decline in total exports of U.S. cotton, if a trade deal between the world's two largest economies remains far down the road.

"What we've seen is that it's not a one-for-one," Adams said. "Losing a bale of exports to China can't be fully replaced by just finding additional markets."

The USDA paid a total of 12 billion dollars last year to bail out eligible farmers who suffered loss from the trade tensions. A new tranche of payments, made through the Market Facilitation Program, rose to a tally of 16 billion dollars this year.

"I don't think it (helped) last year ... It primarily went to soybean growers, which didn't help me at all," Boddiford said.

He did receive some money for the 800 acres or so of corn that he grew, but that was only "one penny per bushel," he said.

Boddiford said he can speak for "at least 99 percent" of U.S. farmers that they would rather sell to the marketplace if they have a choice. "I'd rather have one-dollar cotton and not even hear from the U.S. government."

Asked whether farmers can count on getting further bailouts from the federal government if the trade spat continues, USDA Secretary Sonny Perdue said in an interview with CNN in June that the current package is only for 2019.

"I'm not going to promise anything for 2020," Perdue said.

OBVIOUS DISAPPOINTMENT

U.S. President Donald Trump tweeted Thursday that an additional tariff of 10 percent will be imposed on about 300 billion dollars in Chinese imports starting Sept. 1.

Speaking to reporters on the White House South Lawn on Friday, Trump did not directly answer a question about whether U.S. farmers would continue to receive bailouts from the government if the trade disputes with China persist.

"Well, obviously I'm disappointed!" Boddiford said in comments to the new tariff threat. He said there should have been more talks and deliberations within the administration before Trump made an announcement like that.

"Obviously, it's detrimental to the market," Boddiford said. "I just looked at the market a while ago, corns (prices) are down 9 cents, wheats down 13, soybeans are down 18, cotton down 72 ticks."

Regarding the ongoing bilateral negotiations, Boddiford complained that there's been a lot of "talk about the trade talks" in the United States.

"Let's move forward," he said.

Apart from trade issues, farmers have other things to worry about -- adverse weather conditions and rising input costs.

With drought hitting the southwest and hurricanes sweeping through the southeast, 2018 was a particularly tough year for cotton producers.

Boddiford recalled that the ground was dry and conducive to cotton growth when he planted the crop. But a 13-inch rainfall afterwards that continued for 17 straight days reversed the situation. "You can't even walk out in a field because it's so boggy."

Yet Boddiford has no plans to quit farming. "I want to play in the farming game ... I think it's beneficial to us, and it's beneficial to your country," he said.

(Xinhua reporter Hu Yousong in Washington also contributed to the story.)