The Hong Kong Exchanges and Clearing Limited topped the world's IPO league table for a second straight year in 2019, underpinning the charm of the financial hub to global businesses and investors. But Hong Kong needs to say no to violence to cherish its status as a global financial hub.

HONG KONG, Jan. 8 (Xinhua) -- The Hong Kong exchange topped the world's IPO league table for a second straight year in 2019, also the seventh time in the last 11 years, underpinning the charm of the financial hub to global businesses and investors despite social unrest dragging on for about 7 months.

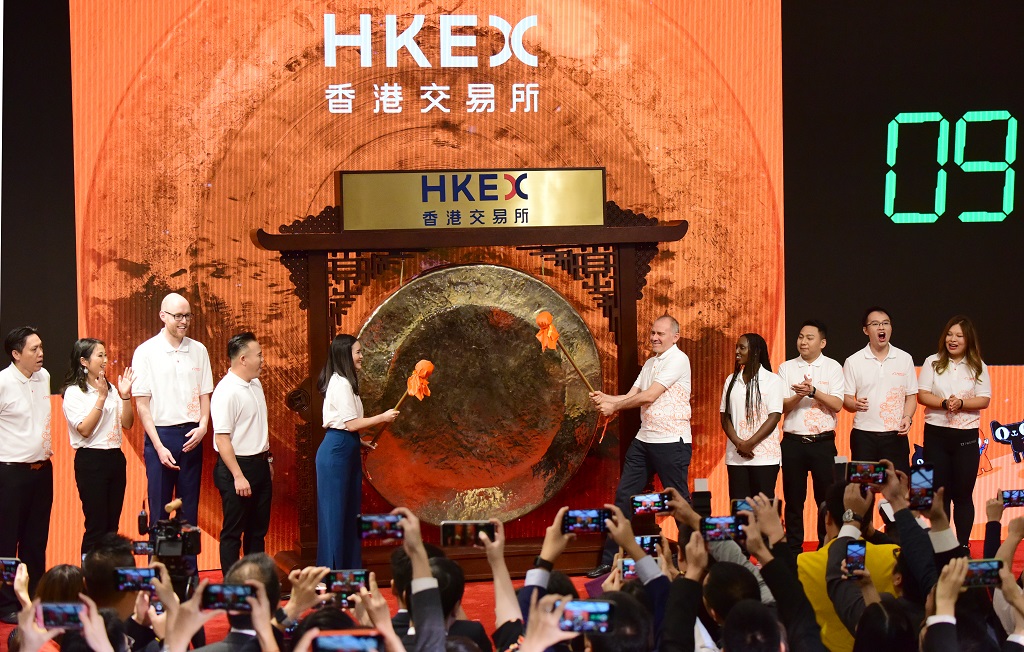

Photo shows guests attending a ceremony of Alibaba's debut on the main board of Hong Kong stock exchange in Hong Kong, south China, Nov. 26, 2019. (Xinhua/Zhu Xiang)

STELLAR PERFORMANCE

A total of 183 businesses raised 312.89 billion Hong Kong dollars (about 40 billion U.S. dollars) on their debuts on Hong Kong Exchanges and Clearing Limited (HKEX) last year, up 8.64 percent from that of 2018, HKEX said.

The stellar performance reaffirmed Hong Kong's position as the most popular fund-raising market in the world, with Shanghai and Nasdaq ranking the second and the third places for 26.91 billion and 26.76 billion U.S. dollars, respectively.

KPMG partner Paul Lau said Hong Kong remains the top choice for both Chinese and overseas companies, evidenced by a series of world-class listings in 2019, including that of Alibaba Group Holding and Budweiser Brewing Company APAC.

As the largest Hong Kong IPO last year, the Chinese e-commerce giant issued 500 million shares plus an over-allotment option of 75 million additional new shares to raise up to 101.2 billion Hong Kong dollars. Following Alibaba, Budweiser, the major beer company in the Asia Pacific, raised 45 billion dollars.

Thanks to the new blood, HKEX's market capitalization jumped 27.6 percent from a year ago to 38.17 trillion Hong Kong dollars at the end of December, and a new record of 38.36 trillion dollars was set on Dec. 30, 2019.

HKEX carried out a bold reform on its listing rules in 2018, lowering the thresholds for companies in bio-tech sector and with weighted voting rights structures, which has provided a major boost for the fund-raising market to stay prosperous.

The IPO market here is poised to be competitive this year, with the new economy and international listings as key drivers, a KPMG report said. "Alibaba's successful secondary listing could prompt other mega-sized Chinese technology companies currently listed overseas to consider returning to Hong Kong."

Then Hong Kong SAR Chief Executive Leung Chun-ying (6th R) and Chow Chung-kong (6th L), then chairman of the Hong Kong Exchanges and Clearing Limited attend the launching ceremony of Shanghai-Hong Kong Stock Connect in Hong Kong, south China, Nov. 17, 2014. (Xinhua/Lui Siu Wai)

BEHIND THE SUCCESS

On July 15, 1993, Tsingtao Brewery, a leading Chinese beer company, became the first-ever mainland company to be listed on HKEX.

For the following more than 26 years since then, an increasing number of mainland companies thriving on China's economic miracle came to HKEX to raise funds and start their global journey.

Feiyang Group, a Ningbo-based travel agency, was one of those firms with a dream of going global. "With the help of Hong Kong's financial markets, we will be able to more directly reach overseas high-quality tourism resources and made in-depth cooperation with overseas partners," Feiyang's chairman He Binfeng said after a listing ceremony in June.

At the end of 2019, mainland-related companies accounted for more than half of the total companies listed in Hong Kong, contributing 73.3 percent of the market capitalization and 82.5 percent of the turnover.

Without mainland companies, Hong Kong's capital market would not have had today's position, HKEX chairman Laura May-lung Cha has said.

As businesses came, capital followed. Stock Connect, a landmark program linking Hong Kong and mainland equity markets, celebrated its fifth anniversary in November. At the end of October, southbound trading turnover stood at 8.75 trillion Hong Kong dollars, with mainland investors held nearly 1 trillion Hong Kong dollars worth of shares.

After years of cooperation, Hong Kong's financial markets have become closely integrated with the mainland market amid steady opening-up in the Chinese financial markets.

"The more integration, the more benefits," Hong Hao, chief researcher at BOCOM International, said. "In the past 20 years, the success of Hong Kong, the growth of the financial markets here, and the recognition of global investors are a perfect testament to the benefit of the integration."

A trader poses for photos at the trading hall of the Hong Kong Exchanges and Clearing Limited in Hong Kong, South China, Oct. 27, 2017. (Xinhua/wang Shen)

HIDDEN RISKS

The robust IPO market came in as the latest evidence that Hong Kong's financial sector has largely remained intact despite an unrest-hit economy. The Hang Seng Index was at a relatively high level, and no massive capital flight was spotted. The exchange rate of the Hong Kong dollar was also stable.

However, economists have warned that if violent incidents persist, it is only a matter of time for the market to feel the pinch.

"Finance thrives on stability, which is part of the reason that Hong Kong is so attractive to global capital," Ronald Wan, a Hong Kong investment banker, said. "If a place is no more safe, investors will think twice."

Echoing Wan's words, Hong Hao said overseas people are increasingly concerned about the situation here. "New money stops coming into Hong Kong market for now and we're seeing family offices moving money to Singapore and other places."

As the situation once deteriorated at an unprecedented pace months ago, some companies shelved IPOs in Hong Kong in fear of the stock prices being weighed down by social unrest. As a result, there was only one listing on HKEX during the entire August.

Given a lackluster global economy, to top the IPO league table is a hard-won outcome for HKEX, which showed investors' unwavering confidence not only in Hong Kong but also its close ties with the mainland and the rapid economic development and enormous market of China.

Analysts said the "one country, two systems" principle endows Hong Kong with unique strengths and advantages, which, however, can only take effect in a stable and peaceful environment.

Hong Kong needs to say no to violence and cherish its status as a global financial hub, HKEX Chief Executive Charles Li Xiaojia said, stressing that "violence is a road to an abyss." ■