NEW YORK, Sept. 30 (Xinhua) -- Bitcoin, the most famous cryptocurrency not backed by any government, has seen its value tripled since the beginning of this year, sparking debate about regulations amid bubble concerns.

More and more governments started to take actions to prevent the risks from blowing up, while experts and financial institutions are issuing warnings for investors against overheating cryptocurrencies.

SPECULATION

Robert Shiller, a Nobel laureate and professor of economics at Yale University, said earlier this month that Bitcoin resembles a bubble because bubbles are promulgated by stories.

Shiller, who won the Nobel Prize in Economics for his work on economic bubbles, told media what's driving bitcoin at the moment is only a story, which started from its mysterious creator, Satoshi Nakamoto, who created the currency and then disappeared.

JPMorgan Chase & Co. CEO Jamie Dimon is more critical of Bitcoin. He said last month that the digital currency was "a fraud" that would eventually blow up.

Bitcoin mania is reminiscent of the tulip bulb craze in the 17th century, he said, stressing that he would not allow JP Morgan traders to trade it.

David Yermack, a professor of finance at New York University Stern School of Business, said cryptocurrencies can hardly be considered as real money as they don't do well as a unit of account, a medium of exchange, or a store of value -- three basic properties real money should have.

Yermack said Bitcoin trading is "pure speculation" and anyone who invests in this is "buying an asset that is so new that no one really understands and is not really getting any of the regulatory protection that you would get in the stock markets or the commodities markets."

"You need to be prepared to lose your whole investment because that could happen easily if you go into one of these things," said Yermack.

REGULATION VACUUM

With no previous experience, governments have been struggling with regulations and laws on the trading of cryptocurrencies and other related activities.

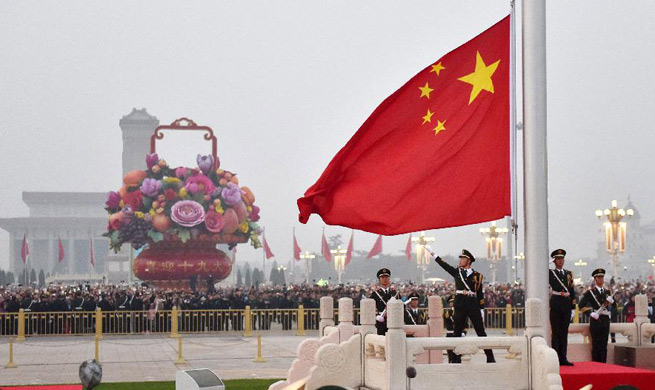

The Chinese government has already taken steps to protect the interests of investors, with authorities ordering a ban on initial coin offerings (ICOs), a nascent form of fundraising in which technology start-ups issue their own digital coins, or "tokens," to investors to access funds as the rapidly expanding market spawned concerns about financial risks.

ICO activities were halted in China starting Sept. 4, and ICO platforms could no longer engage in exchange services between fiat currencies, virtual coins and tokens.

"ICOs, in essence, are kind of unauthorized and illegal public fundraising, which is suspected of being related to criminal activities such as financial frauds and pyramid schemes," China's central bank said in a statement.

ICOs allowed companies to issue cryptocurrencies to investors in exchange for currencies with more liquid value such as Bitcoin, without the need to follow rules associated with traditional channels such as IPOs.

Unlike IPOs, in which investors buy stocks in companies, investors in ICOs receive digital coins developed by the firms, which could appreciate in value if the companies fare well and the demand for their currencies grows.

"It sounds similar, but the mechanism of the sale is totally different," said Yermack.

He pointed out that there's no investment banker building a book of business, and the way in which customers interact with asset is totally different from having a broker on the stock market in an ICO.

Several other countries have also started to take note of the risk of Bitcoin.

In a notice on Aug. 28, the U.S. Securities and Exchange Commission warned investors of potential scams involving stocks of companies claiming a relationship or engagement with ICOs.

Singapore and Sweden have been reaching out to academics and entrepreneurs, holding hearings and organizing conferences for regulation advice.

It might take years for governments to form appropriate laws and regulations, Yermack said.

However, despite risks and concerns brought by cryptocurrencies, experts have seen an enormous potential of blockchain technology born with Bitcoin.

"You're going to see continued innovation using blockchains both for payments and for investment products, but even more so for things like supplychain management, identity protection, government records for immigration, health care," Yermack said.

Both financial and tech industries have been embracing the blockchain technology, and are excited at the possibilities it opened up and the potential new businesses that might be worth trillions of dollars, experts said.