by Peter Mertz

DENVER, the United States, Jan. 20 (Xinhua) -- The National Western Stock Show (NWSS) has attracted beef and cattle industry players since 1906, but this year's show broke all the records.

Perhaps the 80 billion U.S. dollar American business was reacting to anticipated enormous sales to China - a hot topic among industry insiders.

The 15,000 who attended America's premiere cattle show 112 years ago would have been stunned by the epic event that unfolded during the past two weeks in the U.S. western state of Colorado.

Today's event has mushroomed into a showcase of America's farm life - an agricultural sector of the U.S. economy that has been the backbone of the county since it was founded.

There were 120 competitions and activities in NWSS 2018 that included woodcarving, pedaled-tractor races, and the American-favorite bull riding competition, as well as prizes awarded to the best-condition and largest cattle in the land.

But "China talk" filled the back boardrooms this week, where America's big beef men gathered.

"The amount of beef going into China today is miniscule compared to its potential," said Bill Hammerich, CEO of the Colorado Livestock Association, whose convention booth was packed during the show. "We're hoping to see that jump soon."

"American corn-fed beef is a sought-after commodity around the world, and China is no exception," said Todd Sigman of Dinklage Feed Yards in Fort Morgan, Colorado.

With 30 million cattle and calves slaughtered each year, the U.S. is the world's largest beef producer and fourth-largest exporter, seeing global sales of 5.4 billion U.S. dollars in 2016.

Beef production in the United States increased for the fourth straight year in 2017 and is projected to hit a 20-year high of about 28 billion pounds (12.7 billion kilometers) in 2018, according to U.S. Department of Agriculture (USDA) statistics.

Meanwhile, China has emerged as the top global buyer in recent years, with imports increasing from 275 million U.S. dollars in 2012 to 2.5 billion U.S. dollars in 2016, the USDA says.

"China has a middle class that is growing exponentially - larger than the entire U.S. population," Sigman told Xinhua Friday.

"So with more money and more purchasing power, the demand for quality beef has increased as well. Corn-fed beef is unique only in the U.S.A.," Sigman said.

Before China banned U.S. beef in 2003 after an outburst of mad cow disease, America accounted for 70 percent of China's beef imports, according to the USDA. The ban jolted the industry.

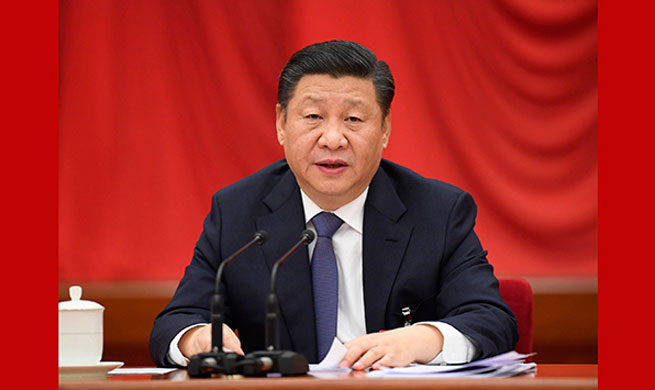

So when U.S. President Donald Trump and Chinese President Xi Jinping met in Florida last April, they vowed to fast-track American beef exports to China, representing a "win-win" for both nations.

"Cattle feeding has been a struggling industry in the past decade," said Joe Newton, a ranch hand from Greeley, Colorado.

Newton spoke to Xinhua from the sun-filled parking lot of the Denver Coliseum that was filled with pick up trucks wearing Trump bumper stickers. The massive show filled several venues in Denver, including the 1954 Coliseum where traditional rodeo events such as barrel and bull riding drew large audiences.

And the week's 60-degree weather in America's Mile High City has been atypically warm, another factor that drove record numbers to the cattle show.

"Trump is helping ranchers and farmers by selling beef to China," Newton said Friday.

"The president has revived the coal industry as well. He is very popular in this part of rural America," he told Xinhua.

Last November, JD.com, the second largest online retailer in China, struck a 200 million U.S. dollars deal to import beef from Montana ranchers over the next three years.

But U.S. industry experts told Xinhua that deal was "more show than go," and the big money is on hold pending negotiations over China's quality standards.

Hammerich told Xinhua "a lot of conditions" still need to be hammered out in the agreement with Chinese buyers before beef sales will explode.

"Part of the trade agreement requires that the cattle (China) receives cannot have come from animals who have received performance enhancing feed," said Hammerich, a requirement that has slowed the export endeavor.

Hammerich soundly defended the industry's well-known practice of using "beta agonists" to enhance the ratio between fat and tissue and produce more lean beef, and "hormone implants that increase the average daily gain and efficiency" of the cattle.

The new Chinese restrictions mirror European Union concerns over American beef exports that resulted in a 1989 ban on U.S. meat containing artificial beef growth hormones, despite its USDA approval.

The EU ban was amended in 2003 to permanently stop one hormone - estradiol.

And a 2014 Texas Tech University study said, "although there are significant benefits (to the use of beta agonists), an increase in death loss of cattle raises questions about welfare implications of its use."

"But when it comes to perception and politics - those rule the day," said Hammerich, who was raised on a ranch in Rifle, Colorado, in a high-elevation, small town on Colorado's Western Slope.

Hammerich said his industry was "was disappointed they imposed some of these conditions," but that he was still optimistic for a modification of the deal currently on the table.

"We're cautiously optimistic," echoed Dinklage's Sigman.

In 1867, there were only 28.6 million cattle in America, feeding on mostly the open range. Today, there are 93.5 million cattle fed on corn, hay, silage and grass.

With the average beef cattle requiring 3,600 pounds of food a year, the cattle feedlot industry is a 36.4 billion U.S. dollars industry that alone could feed 800 million people a year, according to a 1997 Cornell University study.

There are 30,219 feedlots in America, according to the National Cattleman Beef Association, with 93 percent handling 1,000 head of cattle or less.

Dinklage is not one of the little players - with feedlots in Nebraska, Colorado and Wyoming - a major player in an unnoticed gigantic cattle industry sector.

Cattle "feeding" revenues amounts to more annual sales than the sale of the cattle and calves themselves - that total 29 billion U.S. dollars a year - according to the USDA.

Sigman, 47, grew up on a small farm in southern Colorado and has been in the ranching industry his entire life, even working on construction crews in 1986 that built feed yards.

He told Xinhua he has been happy to host Chinese delegates to inspect his company's feed facilities in anticipation of the sales boom. But like many in the cattle business, Sigman says money talks.

"Over the years we have heard a lot of promises about the market and an increase in trade that has not happened yet," Sigman told Xinhua.

It may take months, perhaps longer for the verification process to become "mutually acceptable," but other market changes will factor into the bottom line as well, he added.

For example, the reduction of black market beef currently coming into China from Southeast Asia will have to be factored into the American export numbers, Hammerich said.

"It will take time for the market to adjust from beef currently coming in through Singapore, Hong Kong, and Vietnam," he said

So even with an increase in sales to China, the decrease in export sales to middleman countries will delay the bottom line profitability of beef sales to China, according to Hammerich.

American beef businessmen call the new trade transparency "a vast improvement in the export process," but anticipate a lengthy time before China's 300-million-member middle class enjoy an affordable American steak at their dinner table.