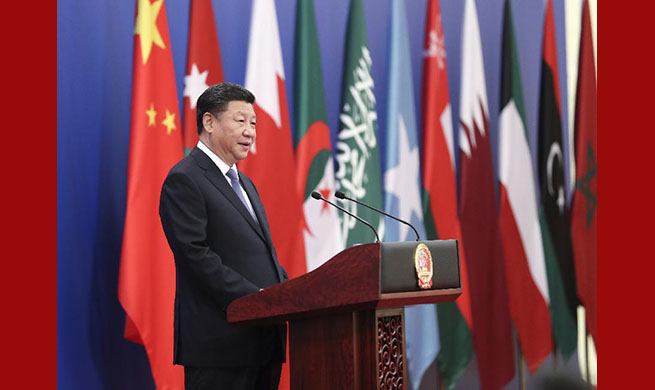

ANKARA, July 10 (Xinhua) -- As Turkey's President Recep Tayyip Erdogan ushered in the new executive presidential system on Monday, a new team was appointed in charge of the country's ailing economy, a move that has sent the national currency plummeting amid insisting calls for structural reforms.

Berat Albayrak, 40, Erdogan's son-in-law, will hold the reigns of the powerful and become new Treasury and Finance Ministry, while his appointment received an unwelcoming reaction from markets, with Turk currency lira falling from 4.52 to 4.74 against the U.S. dollar in several hours on Monday.

The lira has lost about one-fifth of its value against the dollar since the start of the year, despite regaining some ground Tuesday morning amid a generally weaker dollar against emerging-market currencies.

Albayrak served previously as Energy and Natural Resources Minister. The new cabinet, announced late Monday, was keenly awaited for an indication of what Erdogan, who is in control of Turkey since 2003, plans for the future of the NATO and G20 country, especially in regards to the vulnerable economy.

"It is clear that foreign financial markets are not seeing the appointment of the economy team as a market-friendly one," Enver Erkan, an Istanbul-based senior economic analyst with GMC Forex told Xinhua.

He indicated that the "old economy team" consisting of Deputy Prime Minister Mehmet Simsek and Finance Minister Naci Agbal, deemed to be market-friendly figures, had not been maintained in the new cabinet.

"We should be prudent and wait and see what the new administration is planning. If good decisions are taken, the result can only be beneficial," said Erkan, insisting on the need for Turkey to implement long awaited structural reforms to make the national economy more resilient against domestic and international shocks.

Investors are concerned that authorities aren't committed to unwinding months of stimulus that inflated the current account and budget deficits and left assets exposed as major central banks scale back years of loose monetary policy.

Political pressure on the central bank to not raise rates in the face of accelerating inflation has also stoked worry about the policymaker's independence.

Erdogan, who was sworn in as Turkey's first executive president on Monday, told investors in May that he plans to take more control of the economic policy in his new role. He has also pledged to lower interest rates, worrying investors who say the central bank needs to keep real policy rates high to support the nation's assets and help the economy.

The Turkish economy grew at a spectacular 7.4 percent last year and the central bank has raised interest rates by 500 basis points since April.

While economy was Erdogan's biggest asset for more than a decade, the government debt has exploded, fueled by borrowing under a crippling double-digit inflation and unemployment.

High inflation, 15 percent in June, which is the highest for the last 14 years, has also pushed the government to hike prices, making lower classes vulnerable to the rising living costs. Observers expect also significant price increases in the upcoming period, including electricity and natural gas.

During his inaugural speech, President Erdogan said that the new system is vital to driving economic growths and promised to take action to restore confidence in the embattled economy.

"We are leaving behind the system that has in the past cost our country a heavy price in political and economic chaos," Erdogan said shortly after a presidential decree foreseeing that the president will from now on appoint the central bank governor, deputies and monetary policy committee members for four-year terms.

Previously governors who are to be independent in policymaking used to be appointed by the cabinet for five years.

Experts are convinced that Turkey's economy needs urgent action now that the new system is fully implemented.

"There are three top challenges facing the Turkish economy: The impact of trade wars in the global scene; additional regional instabilities stemming from the U.S. anti-Iran sanctions; and ineffective, unsuccessful management of the national economy," political analyst and journalist Serkan Demirtas told Xinhua.

"An economy with at least 15 percent annual inflation, with around 200 billion U.S. dollar debt as well as with a currency in constant depreciation, should therefore prepare for some very stringent measures," said Demirtas.

He added that borrowing is now much more expensive following the U.S. Federal Reserve's decisions to hike interest rates, which will likely be followed by European Central Bank.

However, officials of the new Ankara administration remain optimistic on the prospects of a recovery for the economy based on "harmonization of monetary and fiscal policy" under the new presidential system that Turkey is getting to know slowly after decades of parliamentary control.

"Steps to ensure harmony at the very top of monetary and fiscal policy have already been taken anyway, but they will continue at a faster pace," said Cemil Ertem, senior economic adviser to President Erdogan in a column for the Milliyet Daily.

Turkey now plans to prioritize the fight against inflation and to boost employment, said Ertem, adding that "I expect powerful steps to be taken in this direction and an urgent reform program to be announced."