LONDON, July 16 (Xinhua) -- The rise of Chinese consumers is "crucial for China's sustainable success," said former Goldman Sachs chief economist Jim O'Neill.

"Without doubt the rise of the Chinese consumer in my judgement is easily the single most important economic development ongoing in the world," O'Neill said in a recent interview with Xinhua.

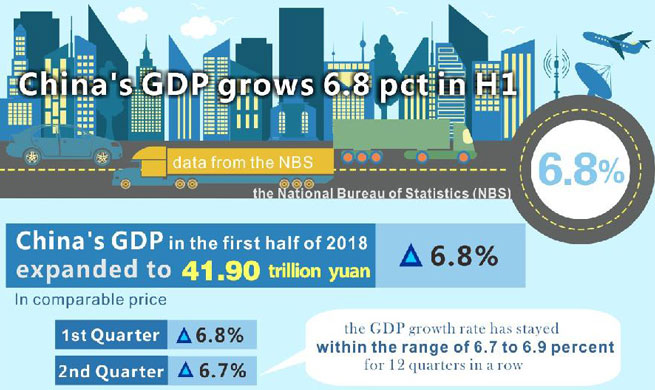

According to China's National Bureau of Statistics, consumption has contributed 58.8 percent to China's economic expansion in 2017.

While illustrating that the most iconic U.S. company Apple sells more iPhones to China than it does in the United States, O'Neill said "that is one of the most vivid illustrations of the rise of the Chinese consumer."

The British economist also said that the rise of the technology sector and the growth of Chinese entrepreneurship was "really quite striking."

The rise of iconic companies like Tencent and Alibaba shows that China is "going in a right direction," said O'Neill, noting that ultimately the most successful economies in the world are featured with innovation and creativity.

"The signs in the past couple of years are more encouraging than many people expected and I just hope it continues and maybe even accelerates," he said.

Impressed by China's economic volume which contributed nearly 50 percent to the global GDP in the past decade, the British economist said he was more excited with the shifting nature of the economy 40 years after China began to implement its reform and opening up policy.

"It was quite early evidence of the switch of the Chinese economy to the service sector and away from what I call the old China of the Noughties (2000-2009) which was based on heavy industry and in particular low value added exports," he said.

China's economy ended on strong footing with a better-than-expected growth rate of 6.9 percent in 2017. Official data showed an improved economic structure, with new growth drivers emerging and outdated capacity fading.

New-energy vehicles, industrial robots, solar power and integrated circuits outshone most other industries in terms of output while heavy industries like the mining and cement sectors saw their output either decline or grow slowly.