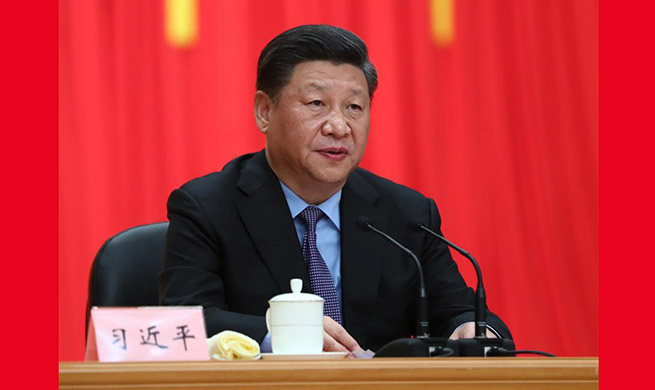

GUANGZHOU, April 13 (Xinhua) -- There is an over 600 billion U.S. dollar shortfall for infrastructure investment in Belt and Road regions every year, said Zhou Xiaochuan, vice chairman of Boao Forum for Asia.

Zhou, also former central bank governor, made the remark at the 2018 High Level Policy Forum on Global Governance running from April 12 to 13 in the south China city of Guangzhou.

According to the Asian Development Bank, between 2016 and 2020, countries in the Asia-Pacific region (China excluded) will need about 500 billion U.S. dollars in infrastructure investment every year, but the public and private sectors can only provide a total of 200 billion U.S. dollars a year.

"According to our calculation based on that ratio, the shortfall in the infrastructure investment of the Belt and Road regions is over 600 billion U.S. dollars every year," said Zhou.

Data shows that from 2014 to 2017, the Export-Import Bank Of China issued loans of more than 930 billion yuan (148 billion U.S. dollars). By the end of March, outstanding loans lent by the bank to countries along the Belt and Road was more than 810 billion yuan, up 29.7 percent year on year.

Li Ruogu, former chairman of the Export-Import Bank Of China, said that a major challenge of carrying out the Belt and Road Initiative is a serious shortage of funding.

Based on China's experience in the past 40 years, the total investment in its fixed assets was estimated at more than 500 trillion yuan. The total population of the Belt and Road regions is three times that of China, and the combined land area is about four times that of China, which means the demand for investment will be much greater, he said.

Wang Yiming, deputy director of the Development Research Center of the State Council, said the Belt and Road regions are mainly developing and emerging economies, which are relatively weak in economic strength and financing capability but heavily in debt.

In this regard, experts suggested that it is important to mobilize as much funding as possible for countries along the Belt and Road, meanwhile, those countries should make policies that are conducive to attracting foreign investment.

Wang said the PPP model applied in Belt and Road related infrastructure projects had worked well in recent years. With a flexible operating mechanism and the concept of a win-win development, it has the potential to attract more social capital.

Statistics show that since the Belt and Road Initiative was proposed in 2013, Chinese banks have participated in more than 2,600 related projects, issuing loans totalling over 200 billion U.S. dollars.

By the end of 2017, a total of 55 banks from 21 Belt and Road countries had set up institutions in China.