NANCHANG, April 5 (Xinhua) -- What happens to your digital assets when you die? The question ignited hot discussion across China as life and death re-emerged as a topic on Tomb-Sweeping Day.

The deposits on leading online payment platforms including Alipay and WeChat pay, as well as accounts of social media sites like QQ are among the digital assets that once concerned Yang Yang, a 29-year-old Beijing office worker, until she listed them in her will.

"More and more young people are managing their money online rather than saving in banks. If I suddenly die, my grieving parents can be left without access to my online accounts," Yang said.

Digital assets are becoming a more important part of a person's estate. Yang made her will at the China Will Registration Center in 2014. She listed her digital assets including three insurance policies and savings on Alipay and WeChat in the will, and named her parents as designated beneficiaries.

Yang's parents did not understand. "They saw it unnecessary and ominous," she said.

Talking about death is still a taboo in China as people fear that it might bring bad luck. However, a growing number of young people are breaking the taboo and even making arrangements for life after death.

At various processing sites of China Will Registration Center, it takes about two hours to complete a set of procedures, including identity verification, writing wills, mental health assessment, fingerprint collection, face recognition, audio and video recording, and judicial review.

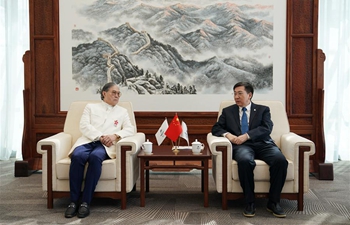

Chen Kai, director of the management committee of the China Will Registration Center, said that although the majority of testators were elderly, the proportion of young people is gradually increasing, with the youngest testator being only 18 years old.

According to a white paper released by the center in 2019, the average age of testators was 71.26 years in 2018, down from 77.43 years in 2013, based on analysis of more than 120,000 wills.

He said a growing number of people had consulted them on how to deal with "digital assets," in addition to traditional real estate and bank deposits.

"Online financial accounts and game accounts can be written into the will, as long as they are the testator's personal property," Chen said.

Creating wealth inheritance plans in advance used to be taboo, but people's attitudes are changing, with increased belief that planning ahead can ensure family harmony and reduce litigation and disputes.

Chen said only 12.4 percent of the population considered it necessary to make a will in 2013, which rose to 45.86 percent in 2018.

"In the past, I often saw stone-faced people coming to make a will and sometimes crying, but now they chat, laugh and take photographs at the scene to mark the special day," Chen said.